Press release -

NORDIC REBOUND IN 2024 AS DEAL VOLUME INCREASED BY 25 PERCENT

Following two years with significantly declining transaction volumes (-32 percent in 22’ and -59 percent in 23’), this year was equipped for a strong recovery on the back of improved macroeconomy and financing markets. To some extent that played out, although unevenly across the region. In 2024, the Nordic transaction volume reached nearly EUR 26bn across 720 deals, marking a solid 25 percent recovery. However, this remains a moderate figure historically lagging the 15-year average of EUR 35bn, according to Nordic property advisor Colliers.

“We are seeing a gradual improvement of market conditions and activity across the Nordics, leading us back to a normalized and more vibrant market. Although we are on the right path, we should probably expect a stepwise recovery with two steps forward and one step back…repeatedly.” says Bård Bjølgerud, CEO Nordics & Partner at Colliers Nordics.

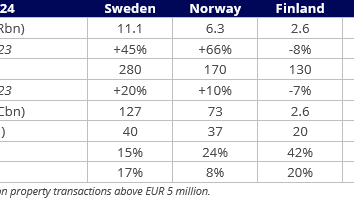

Transaction volume 2024 | Sweden | Norway | Finland | Denmark | Nordics |

Transaction volume (EURbn) | 11.1 | 6.3 | 2.6 | 5.5 | 25.5 |

- Change compared to 2023 | +45% | +66% | -8% | -9% | +25% |

Number of deals | 280 | 170 | 130 | 140 | 720 |

- Change compared to 2023 | +20% | +10% | -7% | -11% | +5% |

Transaction volume (LOCbn) | 127 | 73 | 2.6 | 41 | n.a. |

Average deal size (EURm) | 40 | 37 | 20 | 39 | 35 |

Foreign buyers | 15% | 24% | 42% | 36% | 24% |

Foreign sellers | 17% | 8% | 20% | 39% | 20% |

Källa: Colliers Research, baserat på fastighetsaffärer över fem miljoner euro

Varying development across the Nordics – but ahead of the rest of Europe

In 2024, Norwegian and Swedish transaction volumes pulled in one direction (+66 percent and +45 percent respectively), while Danish and Finnish volumes ended up behind last year’s volumes (nine and eight percent respectively). In a wider perspective, even with the local differences, the Nordic increase stands strong and ahead of the European development observed so far (five to ten percent increase).

“The Nordic region continues to constitute a major and important market in Europe standing for some 15 percent of the transaction volume, and this year Sweden stood out with its increase in number of deals and Norway with its deal volume.” says Joakim Arvius, CEO Sweden & Partner at Colliers Nordics.

Residentials the largest segment in 2024 – but offices the winner

Sector-wise, the residential segment ended in top with 28 percent of the Nordic transaction volume, slightly ahead of logistics and offices (24 percent each). The office market share grew the most (three percentage points), primarily driven by Nordic investors, while foreign investors remained reluctant towards the segment. Almost 70 percent of the foreign investment activity within the office segment was related to divestments.

Parts of the listed sector back as buyers – but as a group still net sellers

In 2024, the listed sector accounted for 13 percent of all acquisitions in the Nordics (five percent in 2023), breaking a two-year declining trend. However, the share of divestments remained elevated and in 2024 the sector stood for 22 percent of all divestments, making the sector net sellers yet again.

“The overall conditions have improved with property values flattening out, improved valuations to NAV and increased equity- and financing market activity. However, it is a separated sector, and others are still struggling contributing to the large share of divestments.” says John Petersson, Acting Head of Research at Colliers Nordics.

Mixed stock market performance – both across countries and segments

So far in 2024, the Nordic development has been quite poor as the COREX Property index stands at minus six percent despite reaching a high of +13 percent in October. Country-wise, COREX Norway stands alone with positive returns, currently at plus five percent, and segment-wise, COREX Mixed has had the strongest development standing at +14 percent. Contrary, COREX Finland (-24 percent) and COREX Office (-14 percent) have been the worst performers.

Positive inflow of foreign capital for the eleventh consecutive year

The decade long trend of positive foreign net capital inflow to the region remained intact as foreign buyers accounted for 24 percent and foreign sellers for 20 percent of the Nordic volume. Despite the positive net inflow there were dissimilarities across the region and in Sweden, albeit not that big, the net flow was negative for the first time since 2016. In Denmark, although even smaller, the outcome was the same.

The five largest property transactions in the Nordic region in 2024:

- Brinova acquiring a residential portfolio in Sweden and Denmark from K-Fastigheter (SEK ~10.8bn)

- Reitan Eiendom acquiring an office portfolio in Trondheim from Entra (NOK ~6.5bn)

- Logistea acquiring 100% of the shares in KMC Properties (SEK ~5.7bn)1

- Catena acquiring a logistics property in Horsens from DSV (DKK ~3.3bn)

- Aermont Capital acquiring 60% of the shares in Svenska Nyttobostäder from ALM Equity (SEK ~5bn)2

1) Based on KMC Properties’ reported holdings in Norway, Sweden, Denmark and Finland in connection with the transaction 2)Total underlying portfolio valued at SEK 8.4bn

Attachments

• Chart: Nordic transaction volumes, 2008-2024

• Chart: Nordic transaction volume split by geography and sectors, 2024 vs. 2023

• Chart: Share of foreign buyers in the Nordic countries, 2024

• Chart: Share of listed property companies on the buy- and sell-side, 2021-2024

• Chart: COREX Indices development, 2024

• Photos

Topics

About Colliers Group

Colliers is a leading diversified professional services and investment management company. With operations in 66 countries, our 19,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 29 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. Colliers mission is to maximize the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.