Press release -

Promising start to 2024: Second half expected to surge further

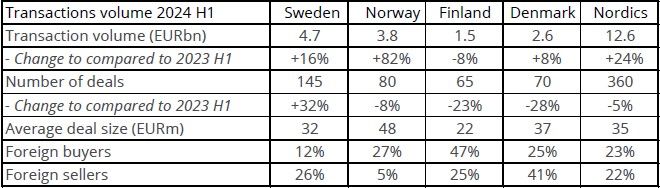

After some years of struggle, the severely impacted Nordic transaction markets are slowly starting to recover.During the first half of 2024, transaction volumes in the Nordic property market reached nearly EUR 13bn, which is 24% higher than the same period last year. Volumes are now slightly ahead of the levels recorded in H1 2014, the period following the weak volumes of 2013, and, in a historical perspective, we are now approaching more normal markets, according to Nordic property advisor Colliers.

“The listed sector most likely reached its bottom in late 2023, and shortly thereafter, debt market activity accelerated quickly with favourable and improved terms. We are now observing similar trends in the direct property market, with an increased number of buyers, a smaller spread between buyers and sellers, and overall improved incentives to finalize deals” says André Lundberg, Head of Capital Markets Sweden & Partner at Colliers Nordics.

Source: Colliers Research, based on property transactions above EUR 5 million.

Large differences across the countries

Despite increased transaction volumes for the Nordics, there are notable differences among the countries. Norwegian transaction volumes improved the most (+82%), followed by Sweden (+16%) and Denmark (+8%), while Finnish volumes lagged behind last year (-8%).

“The increased transaction volumes in Norway can, to some extent, be explained by a few large divestments from pressured investors. However, there is a significant overall improvement in the Norwegian transaction market, which we do not judge to be temporary. Rather, we are experiencing the opposite, with increased activity heading into the second half of 2024” says Frida Tosterud Grov, Head of Capital Markets Norway & Partner at Colliers Nordics.

Office market activity on the rise – but not the top pick for all investors

Sector-wise, logistics remained one of the largest segments, accounting for 26% of the Nordic transaction volume. Notably, offices reclaimed the top spot as the largest segment for the first time since 2019, with a market share of 30% during the first half of 2024. In contrast, the market share for public properties continued to decrease, falling from 17% in 2022 to 5% in 2024.

“The increased activity within the office segment is particularly interesting given the turbulent years that has passed since the Covid outbreak. Internationally, the negative view on offices is almost the opposite from what we are observing in the Nordics, which is obvious when looking at the statistics as the foreign investors have been net sellers in the segment since 2020” says John Petersson, Acting Head of Research at Colliers Nordics.

The listed sector is growing, and activity is high on multiple fronts

Three years of declining buy-side market share were broken in H1 2024, as the listed sector accounted for 8% of the acquisitions in the Nordics, an increase from 5% in 2023. However, there are differences among companies and sectors, with some companies still in need for divestments to improve their capital structure. In the debt and equity markets, activity has been high, with bond issues totalling EUR 3.2bn, equity issues totalling EUR 600m, and two new listings so far in 2024. Given the improved market environment, the listed sector is expected to grow further going forward.

Continued positive inflow of foreign capital – now at the eleventh consecutive year

Following ten consecutive years of positive foreign capital inflow to the region, foreign interest for the Nordics remained positive in H1 2024, although only marginally, as foreign buyers accounted for 23% and foreign sellers for 22% of the Nordic volume. The share of net investments has declined due to differing views on pricing, but there is still a substantial amount of foreign capital on the sidelines, ready to be deployed in the Nordics.

The five largest property transactions in the Nordic region in 2024 H1:

- Reitan Eiendom, through subsidiary, acquires an office portfolio in Norway from Entra (NOK 6.5bn)

- Logistea acquires 100% of the shares in KMC Properties (SEK ~13bn1)

- Norwegian Property acquires an office property in greater Oslo from a syndicate (NOK 2.8bn)

- DK Retail Invest acquires a retail portfolio in Denmark from Rema 1000 (DKK 1.8bn)

- KLP Eiendom acquires an office property in Oslo from Schage Eiendom (NOK 2.5bn)

1) Underlying property value for the combined company

Topics

About Colliers Group

Colliers is a leading diversified professional services and investment management company. With operations in 66 countries, our 19,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 29 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. Colliers mission is to maximize the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.