Press release -

STRONG RESIDENTIAL DEAL FLOW: 2025 NORDIC VOLUMES TOP 2024

The Nordic property transaction market showed clear signs of stabilization in H1 2025, supported by an improving economic outlook and growing investor engagement. Volumes increased across most geographies and segments, with domestic institutions, listed companies, and selected foreign buyers all contributing to the upswing. The increase in average transaction size reflects a greater proportion of portfolio transactions and growing risk appetite among core and value-add investors.

“The momentum is underpinned by greater clarity on interest rates and renewed confidence in long-term fundamentals. While geopolitical and economic uncertainty remain, the overall pick up in transaction activity suggests that investors are repositioning ahead of a more sustained recovery cycle”, says André Lundberg, Head of Capital Markets Sweden & Partner Colliers Nordics.

Source: Colliers Research, based on property transactions above EUR 5 million.

Estimations based on investment activity have been made for the remainder of June in the Nordic markets.

Geographic differences persist despite Nordic recovery

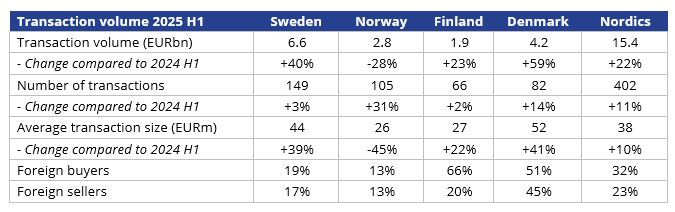

While the overall Nordic market showed a solid rebound in H1 2025, national trajectories diverged. Sweden posted the strongest transaction volume at EUR 6.6 bn (+40% compared to H1 2024), while Denmark also saw a robust volume of EUR 4.2bn (+59%) with both markets driven by large-scale residential and hotel transactions. Additionally, public sector was a prominent segment in Sweden in terms of volume with a transaction volume share of 20%, significantly higher than 8% in H1 2024. In the Nordic region, the proportion of investments in public sector properties increased from 5% in H1 2024 to 12% in H1 2025.

“In contrast, Norway experienced a year-on-year decline in total transaction volume, largely due to a strong H1 2024 comprising high-volume transactions as well as having a challenging interest rate environment as opposed to the other Nordic countries. Finland’s transaction volume, however, increased year-on-year in H1 2025, mostly driven by Apollo/Avant Capital Partners’ residential acquisition from Kojamo of EUR 242m in June”, says Frida Tosterud Grov, Head of Capital Markets Norway & Partner Colliers Nordics.

Shifting investor sentiment among investor types

After several years of subdued activity, private property companies (including e.g. non-listed property companies and construction companies) in the Nordics significantly increased both acquisitions and divestments in Sweden during H1 2025, as their buy-side market share increased from 24% in H1 2024 to 26% in H1 2025 and sell-side market share increased from 19% to a significantly higher 48%. In contrast, listed property companies reduced their market presence. Their share of total transaction volume in the Nordics dropped on both the buy-side (from 26% in H1 2024 to 15% in H1 2025) and the sell-side (from 33% to 10%).

“Debt and equity issuance picked up substantially through bonds and directed issues, indicating improved sentiment in financing conditions and access to capital. The shift signals renewed confidence in public market valuations and more strategic expansion by active private players, particularly in Sweden and Norway”, says Axel Tärn, Head of Research, Colliers Nordics.

Large-scale deals characterize H1 2025

A sign of demand for larger property transactions, often comprising portfolios and arguably more strategic assets, is seen when observing the development of average transaction size year-on-year. Most notably, significant differences exist between the Norwegian market in H1 2025 with a decrease of -45% year-on-year, compared with Sweden (+39%), Finland (+22%) and Denmark (+41%). On a Nordic basis, however, the average transaction size increase amounted to a more modest +10%. The decrease in the Norwegian market can primarily be explained by a strong H1 2024 in terms of volume with numerous high-volume transactions such as E C Dahls Eiendom/Entra, Logistea/KMC, Norwegian Property/Arctic Securities syndicate. Still, Norway’s H1 2025 average transaction size (EUR 27m) remained close to the H1 average for 2020–2025 (EUR 29m).

In the Nordics, prominent transactions include – in decreasing order – CapMan’s Nordic hotel portfolio (EUR 0.9bn), Swedish Fortifications Agency/Intea (SEK 8.2bn), Greystar/NREP (DKK 2.85bn).

Foreign capital remains active – but selectively deployed

While foreign activity remained relatively unchanged year-on-year in H1, larger spreads are observed between the Nordic countries.

Foreign buyers rose from 47% to 66% in Finland, highlighting a greater demand from investors outside of Finland. Apollo/Avant Capital Partners’ acquisition of a rental housing portfolio from Kojamo (EUR 242m) comprised a significant part of this figure, while Swiss Life’s shopping centre acquisition in Turku from CBRE IM (EUR 87m) and Infranode’s mixed use portfolio acquisition in Vaanta from NCC (EUR 80m) also contributed.

On a Nordics basis, foreign investor participation held steady in H1 2025, with international buyers accounting for 32% of total transactions — extending the positive inflow streak to a twelfth consecutive half-year. Foreign acquisitions also increased year-on-year, rising by 9 percentage points. High interest rates, valuation uncertainty, and selective underwriting continue to moderate the pace of deployment, but capital availability remains strong.

Foreign net investments in offices decreased drastically in H1 2025 from H1 2024 with net sellers amounting to approximately 77%, from a previous level of 50%, although office properties in the most attractive locations remain in demand.

The five largest property transactions in the Nordic region in 2025 H1:

- CapMan acquires 28 Nordic hotel properties in Denmark from Midstar (EUR ≈ 0.94bn)

- Swedish Fortifications Agency acquires 7 public sector properties in Sweden from Specialfastigheter (SEK ~8.23bn)

- Greystar acquires a student housing portfolio in Denmark from NREP (DKK ≈ 2.85bn)

- Stena Fastigheter acquires 100% of shares in Källfelt Byggnads AB incl. 1,350 apt. (SEK ≈ 4.1bn)

- Alecta acquires an office property in Sweden from M&G Real Estate (SEK ≈ 2.9bn)

Attachments

• Chart: Nordic transaction volumes, 2008-2025 H1

• Chart: Nordic transaction volume split by geography and sectors, 2025 H1 vs. 2024 H1

• Chart: Share of foreign buyers in the Nordic countries, 2025 H1

• Chart: Share of listed property companies on the buy-side and sell-side, 2022-2025 H1

About Colliers Group

Colliers is a leading diversified professional services and investment management company. With operations in 66 countries, our 19,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 29 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. Colliers mission is to maximize the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.